Share

How to Develop Fintech App | Fintech App Development Guide

Planning to “Develop Fintech App” but before that have you ever wondered, what if technology wasn’t that advanced and there were no digital modes for payment?

Well, we can clearly say, then our lives weren’t that sorted and we always have to worry about our wallets and handbags where we keep the money.

We also have one recent example of Corona. When it was all shut outside and all the activities were taking place through online mode. Whether it is getting medicine online, making payments to others’ accounts or any money transfer activities were taking place through these Fintech Apps only.

Let us discuss what fintech apps are and how to develop fintech app with the best features.

So, Fintech apps are web or mobile apps that deal with financial services. These apps are really common nowadays because many financial services are taking place digitally. And if we talk about the future of this app, then you will be amazed to know the facts. According to one record by a business research company, it is said that the fintech industry will grow to USD 158014.3 million by 2023.

This fintech industry is doing well in the market these days. So if you think you have enough budget to develop fintech app. Then you must go for this app development plan and must hire the best mobile app development company for your project.

Different Types of Fintech Apps

There are several financial apps and their different types, depending upon the area of finance they deal with. Depending upon the different sectors, the fintech apps are categorized and developed.

Some want to develop a fintech app for online payment and simple money transfers.

The banking sector needs it for their customers and services; few fintech apps also allow users to borrow money from their peers through digital lending apps. One advanced use of these fintech apps has been seen through digital investment.

Digital investment is utilized for managing mutual funds or other stock market investments through mobile apps. Depending upon the different sectors there are numerous functions of the Fintech app.

Some of the Fintech app types are as follows:

- Digital Payments

- Digital Banking

- Digital Lending

- Digital Investment

- Consumer Finance

List of Best Fintech Apps

Fintech apps are very popular nowadays and they have changed many things and made money transactions easy. People are liking these financial apps because they have changed things for good. Below we have mentioned top fintech apps with their features.

- Affirm

It provides no-fee loans for one- time purchases to users who do not have a credit card or cash.

Affirm provides finance for Walmart, travel site Expedia, Wayfair, furniture store, mattress store Casper, and other retailers.

Affirm provides point-of-sale financing.

Platforms used to develop fintech app like affirm: Kotlin, Javascript, Lua, Lodash, Jquery, Jquery UI, Java, Ruby.

- Acorns

Acorns is an American-based financial service and financial technology company situated in Irvine, California.

It is specialized in Micro-investing and Robo-investing.

It has 4.5 million users and about $1.2 billion in assets in its management.

Platform used to develop fintech app like Acorns: Android SDK, JavaScript, React, Swift, Ruby, Rails, Kotlin.

- Alipay

Alipay provides payment solutions to Chinese buyers who are buying products from the vendor’s website and paying in RMB (making payments without card or cash).

It deducts the payment in real-time after the purchase from the buyer’s account.

Alipay aims to bring the business and buyers together.

There are 8.5 million transactions through Alipay in a single day. Alipay has 550 million users.

Platform used to develop fintech app like Alipay: React, Java, Lodash, Moment.js, Ant Design, Jquery, Jquery UI.

- Atom bank

Atom bank makes banking more streamlined on tablets or smartphones

Atom Bank provides mortgages accounts, savings accounts, and Current accounts.

It was started in 2016 and does not have any physical branches yet. All the services are available on the app.

Platform Used to develop fintech apps like Atom bank: React, Java, Swift, Kotlin, Gatsby, Groovy, Javascript.

- Citi Bank

It was established as a Citi Bank of New York in 1812. The bank changed its name to Citibank in 1976.

Basic banking, access account, the Citibank account, Citigold, and City priority are five services offered by CitiBank.

The APYs and fees depend on the

- Chime

This is online mobile banking and has no hidden charges or fees. Through this one can manage their money, grow their savings, and can also have fee-free overdrafts.

Users can also get their paycheck with direct deposit. It is one of the high-rated mobile banking apps.

Platform used to develop fintech apps like Chime: React, React Native, Elixir, Ruby, Rails.

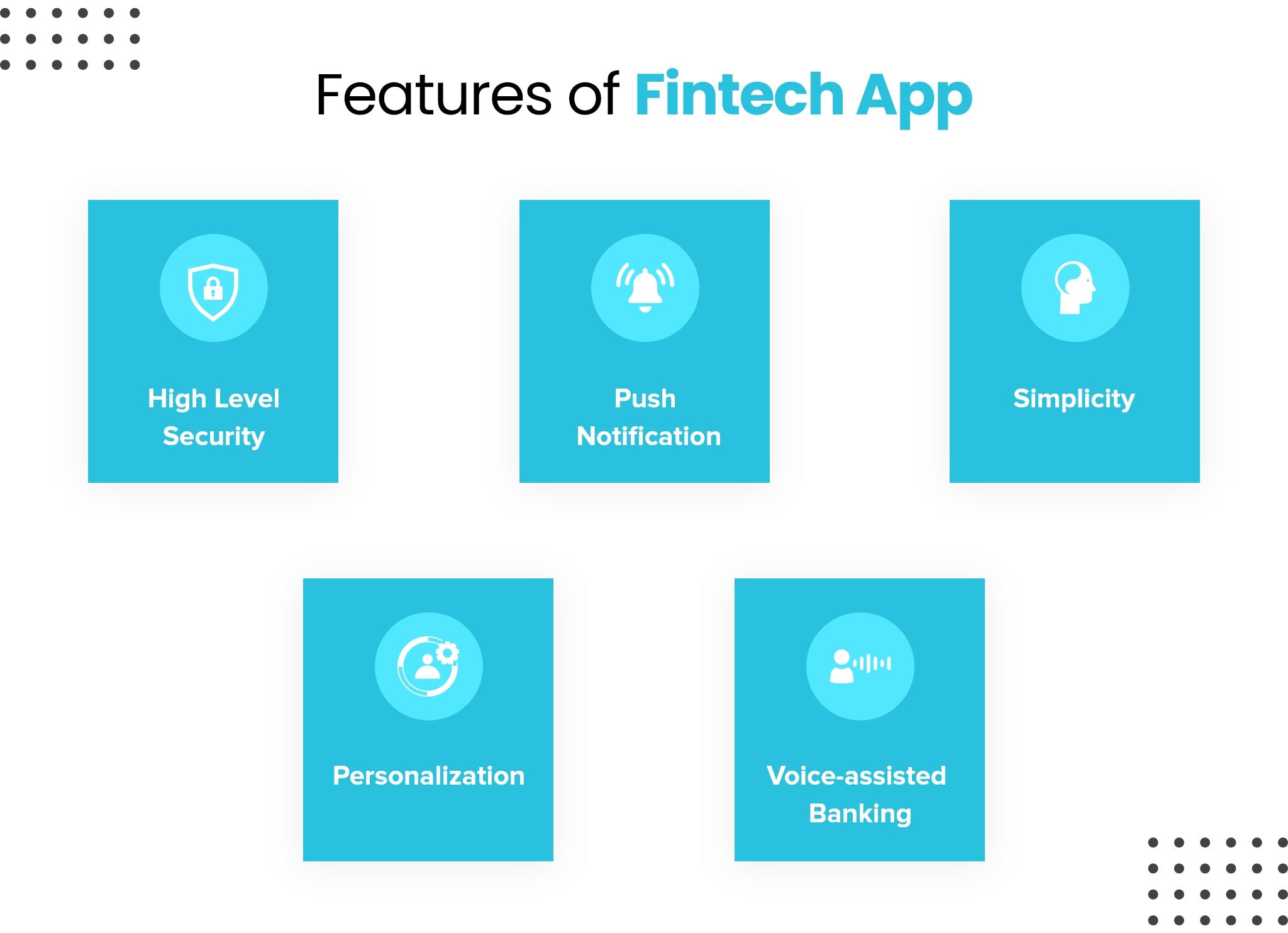

Features of Fintech App

Fintech apps are directly related to our finances and money-related services. Therefore it is very important to integrate the best security features into the app. If you are planning to develop a Fintech app then always remember to add simple yet effective features. These apps require a high level of security and safety for the users.

Let us discuss a few features that can make your Fintech app more secure and safe. The mentioned features will really help you to develop fintech app with the best security functions.

- High-Level Security

High-level security features are an important feature of every Fintech app. Fintech Apps deal with user’s finances and any data breach can cause serious damage to users. Hence, always keep the high-level security at priority while developing a fintech app.

Implement the features like Biometrics and data encryption to your Fintech app to ensure security.

- Push Notification

To provide users with important information through notification it is necessary to implement this feature.

The bank official can send crucial updates, information about transactions, and other information through this push notification feature.

- Simplicity

Fintech apps involve very important functions that are directly related to financial services. That’s why it is important to keep the app simple for use by everyone.

We cannot target a specific age group here, hence we have to keep the functions of fintech apps simple and accessible by all.

- Voice-assisted Banking

Users who are not comfortable with typing can access the app through the voice-assistant feature. This will help in making your fintech app more user-friendly.

- Personalization

The personalization feature is very important for fintech app development. Every user likes to personalize their financial account with the best security features. Allow users to personalize their account or profile on your fintech app with the best and strongest security features.

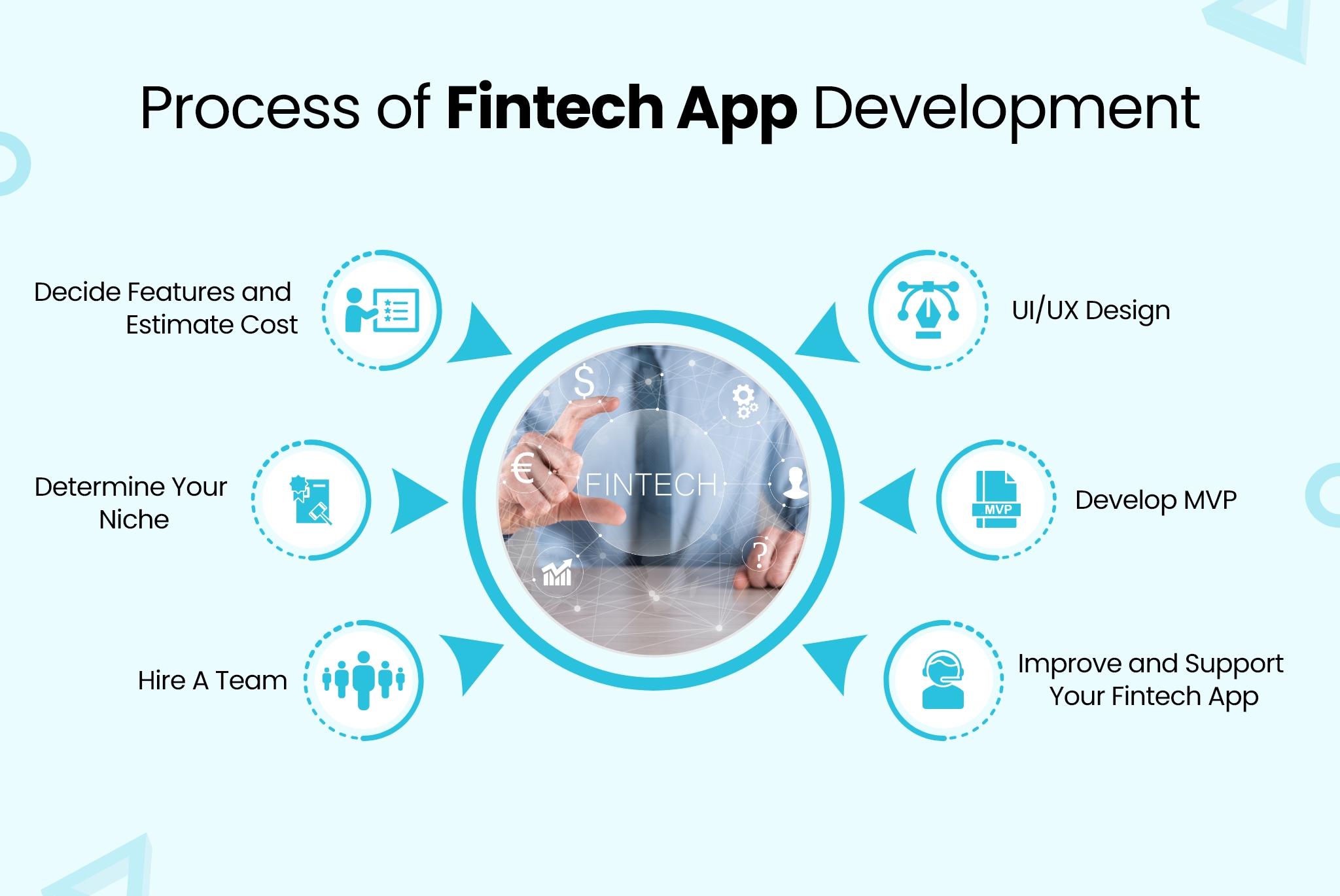

Process of Fintech App Development

Whenever you are planning to develop an app it is very important to go through the right app development process. When you are planning to develop fintech app, then it becomes even more important to pay attention to every aspect of security.

If users will not find your app secure and easy to use, then it will become difficult to retain users. Therefore, always make a proper plan and execute it with full confidence.

Below we have given a step-wise guide to tell you how you can develop a fintech app with ease.

- Determine Your Niche

- Decide Features and Estimate Cost

- Hire A Team

- UI/UX Design

- Develop MVP

- Improve and Support Your Fintech App

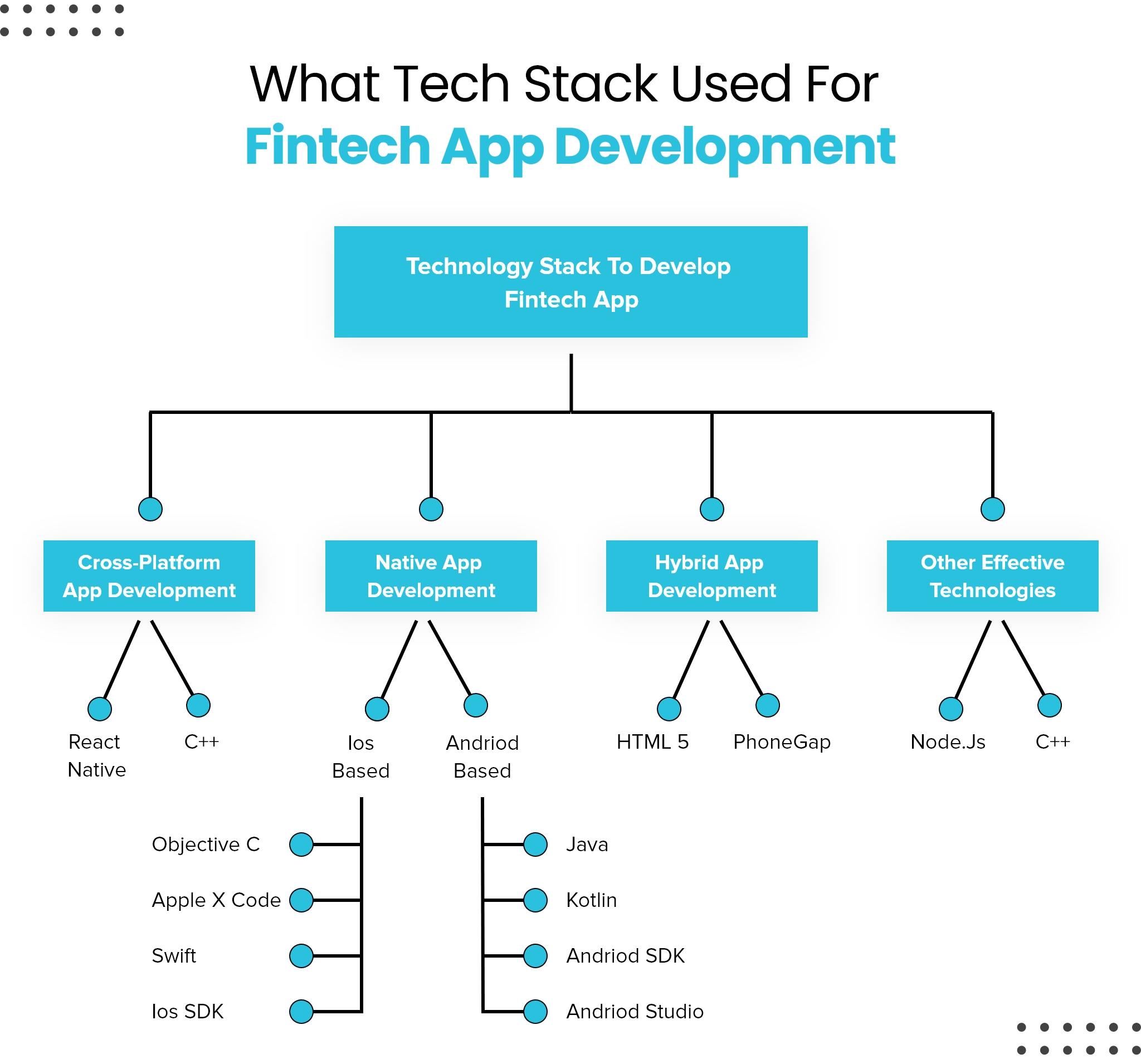

What Tech Stack Used For Fintech App Development

Time has changed and with that technology is also advancing every day. It is very important to walk with current technology and software otherwise you will never succeed in building an amazing fintech app for your business.

The latest technology and software will help you to develop the best app with fewer glitches and bugs. Below we have given a perfect layout for your understanding. If you need any help regarding app development then you can also contact us.

Cost Require For Fintech App Development

Cost requirement is always determined by the number of hours involved in the app development process. If the hours required for the app development process are more, then the development cost will be high. But if you require a basic app with common features, then it will require less time and therefore the cost of development will also be low.

For fintech app development the cost will be reasonable as there are no complications. You only need basic and simple features and app structure. Hence the cost required to develop a fintech app will be affordable in case if you want to know more you can contact a mobile app development company for the extra query.

Wrapping Up

Now everyone is using fintech apps for managing their cash and bank accounts. Users can manage all financial transactions through these fintech apps. So it won’t be wrong to say that the demand for these apps is high. And if you are planning to invest your money in this business then it will be a good choice.

Users always look for better and more secure options for managing their finances, so you can provide users with the best fintech app with our best fintech app development solutions. We hope all your questions have been answered through this blog but still if you have any doubts you can reach us anytime.

Rate this article!

I’m very keen to read about modern technology and I try to put the best in my writing for the readers. Reading more blogs and case studies help me to understand my readers interest. Therefore I try to provide diversification in my writing so that readers do not find reading monotonous and boring. I hope my blogs provide knowledge and are worth reading.